IoT Solutions for the Finance and Lending Industry

Blackhawk.io helps the vehicle and capital asset finance industry to lower credit risk by managing customer payment behaviour.

Using IoT (Internet of Things) devices (also known as GPS tracking), Blackhawk enables lenders to service the sub-prime credit market by:

01.

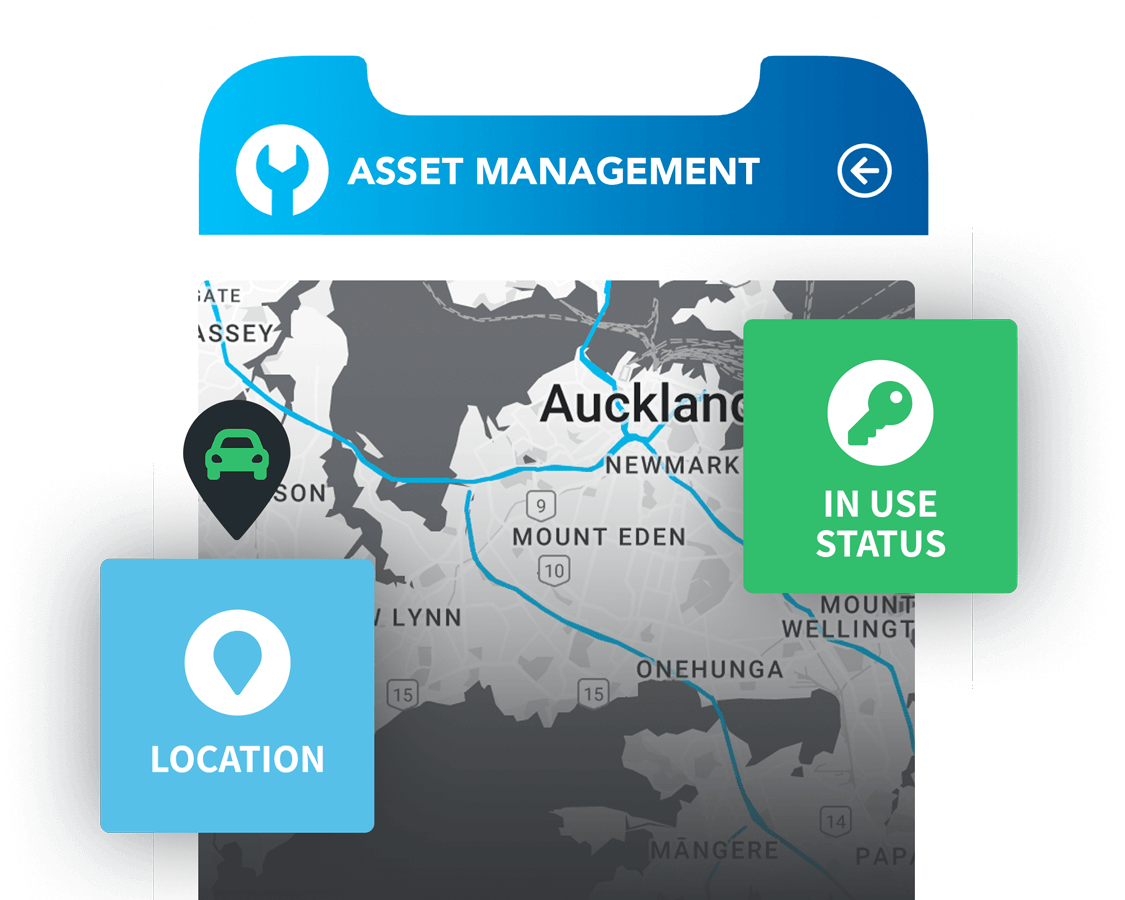

Providing visibility over secured asset location at all times.

02.

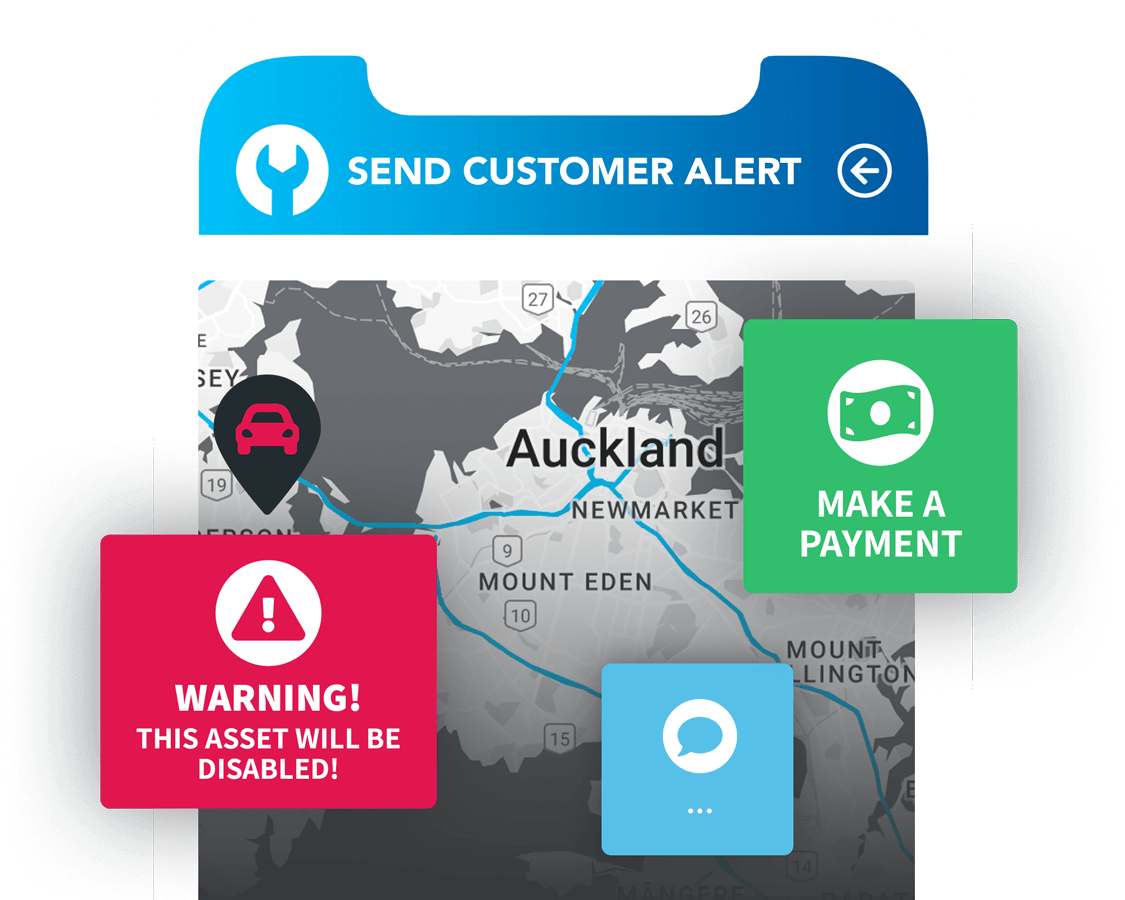

Creating the ability to warn customers of the intent to disable their vehicle or asset (immobilise) if non-payment should occur.

03.

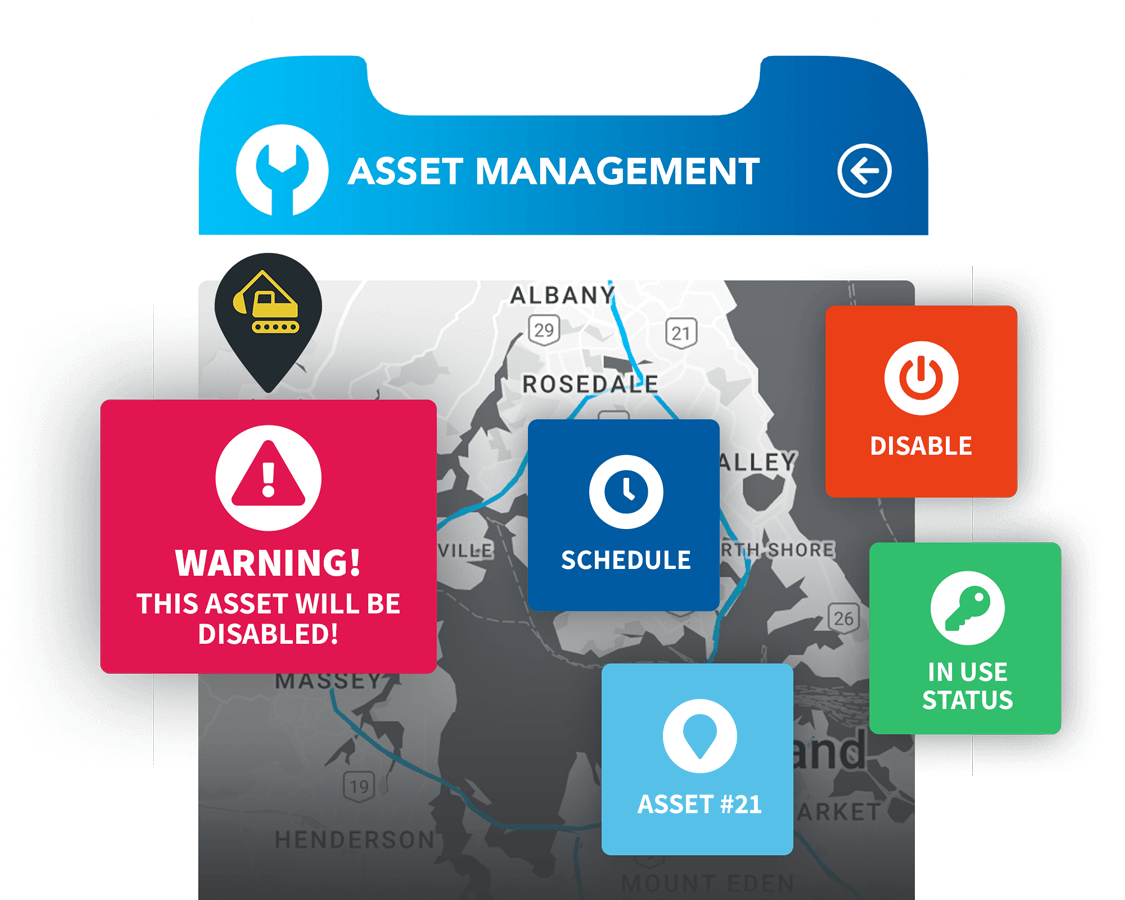

Enabling remote immobilisation of vehicles or machinery to stimulate prompt payment.

Secure Greater Market Share

As part of a total Collection Management process, Blackhawk allows financiers to change the risk profile of lower credit risk graded customers in line with better risk graded segments, therefore expanding the available marketing for leading and facilitating new business or greater market share.

Blackhawk partners with financiers to rapidly secure vehicles when new loans are being approved. The customer is aware that the vehicle is tracked, and the financier could immobilise the vehicle when payments are missed. Blackhawk has proven over a long history of sub-prime finance partnerships to show that the mere presence of IoT is enough to ensure payment compliance. The knowledge that the vehicle can be simply turned off remotely changes the borrower’s motivation to maintain payments, compared to the knowledge that lenders normally must physically locate and recover the vehicle in these circumstances.

Capital Financing

Blackhawk partners with financiers for major capital investment borrowing. For fleets, machinery or other business assets Blackhawk provides anti-fraud verification of the assets’ existence, location, utilisation and history. Blackhawk provides layers of security for assets including:

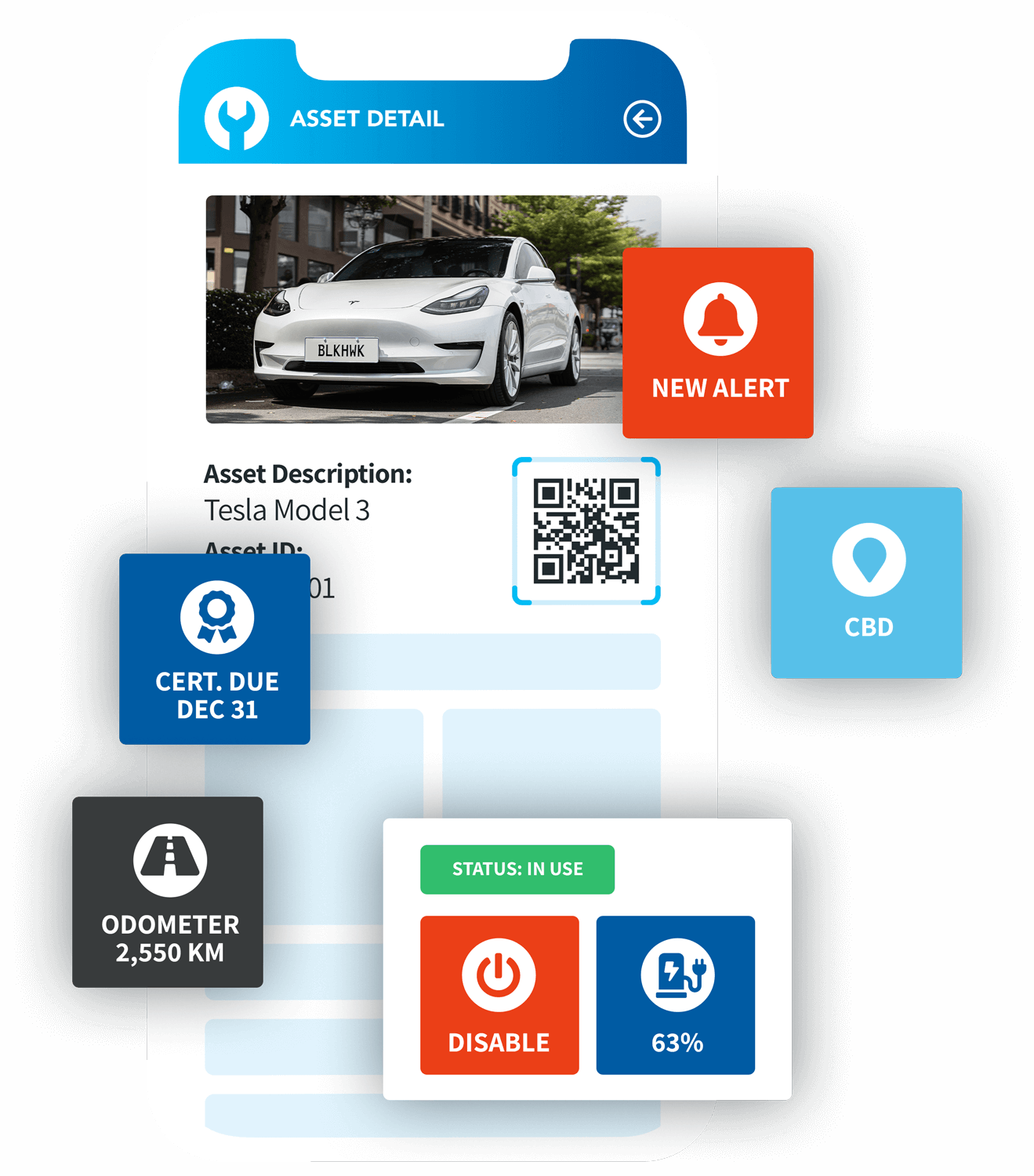

Maintaining a digital register of secured assets.

Installation of QR tags to identify and verify assets. Scanning with a smartphone updates the location of the asset. These scans can be augmented with required photographs for periodic auditing.

Installation of specialised IoT devices fitted to maintain regular location updates. These devices include anti-tamper features to alert if removal is attempted.